Each year, INTRUST Bank presents our economic and market perspectives by addressing key factors impacting the economy, monetary policy, and financial markets. This outlook summarizes our viewpoints on these topics and factors to watch as we emerge into 2019.

U.S. Economy: Aging Slowly

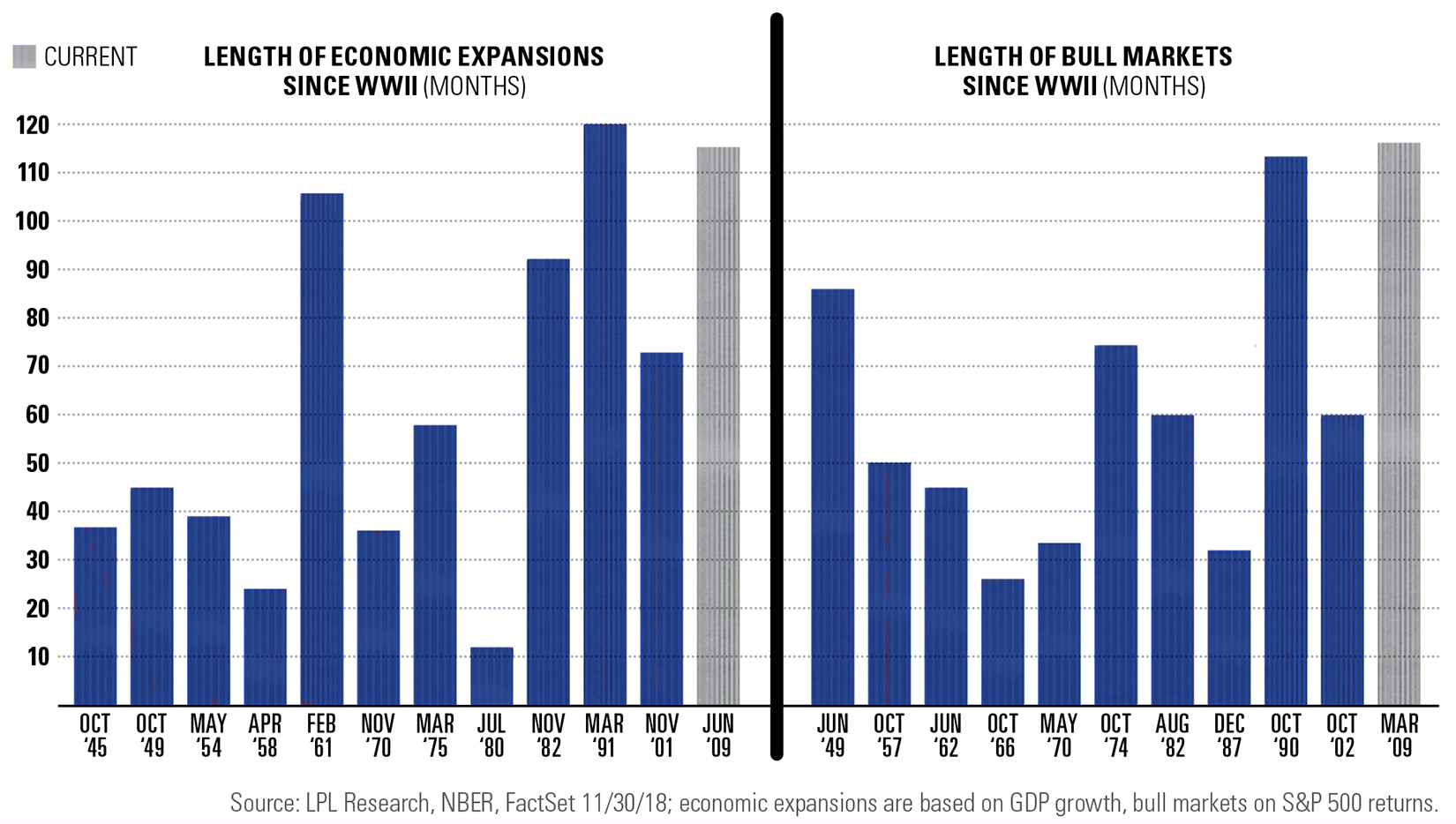

The U.S. economic expansion will likely become the longest on record this summer. However, we anticipate the aging economy to slow in 2019 and decelerate more the latter part of the year. Tightening financial conditions, slower global growth, and the fading of the fiscal stimulus are key factors influencing this outlook.

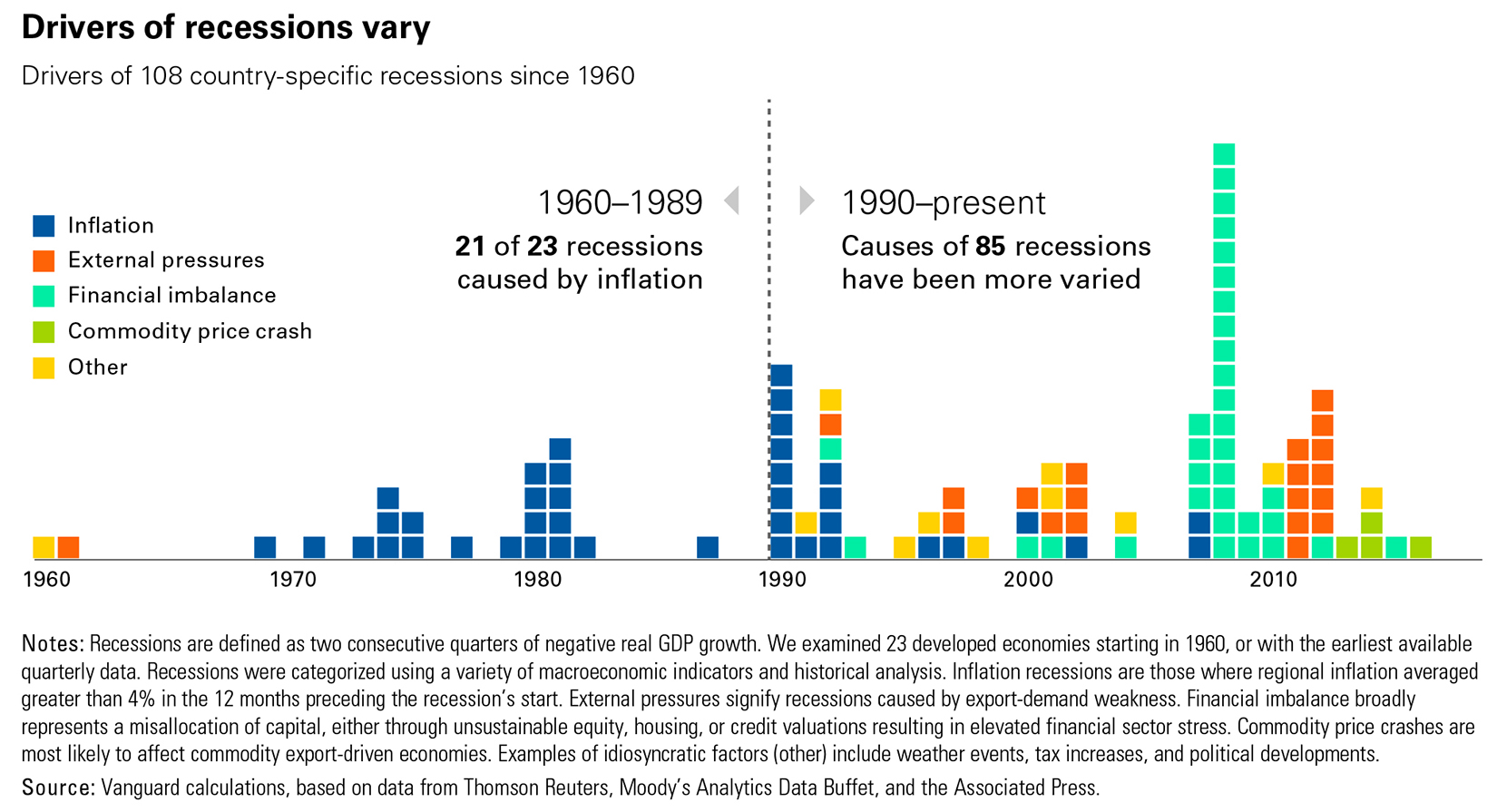

Although we believe the U.S. economy has entered the late stage of this expansion, odds of a recession in 2019 remain relatively low. We currently do not see evidence of excessive inflation that has triggered some past recessions, nor the consumer overspending or credit bubbles that have led to other downturns.

U.S. inflation should remain well within Fed targets, around 2%, as wage inflation will likely be offset by lower commodity prices from slowing global demand. The breakeven inflation expectations implied by the U.S. Treasury Inflation-Protected Securities (TIPS) further support this view of moderate inflation.

We anticipate the unemployment rate remaining near its lowest level since the Vietnam War, but some slack may persist in the labor market. For example, the share of prime-age workers, ages 25 to 54, holding or seeking jobs should continue trending higher in 2019, but remain well below its pre-crisis level. This persistent weakness in the labor-force participation rate will likely prevent sharp spikes in wages from occurring this year.

Uncertainty remains around Fed tightening in 2019. In December, Fed Chairman Powell suggested the possibility of additional rate hikes. However, market expectations based on Fed funds futures imply further rate hikes in 2019 are unlikely. Whether or not the Fed increases rates this year, we appear to be nearing monetary policy normalization in the U.S. – the point at which the Fed halts further rate increases amid moderating inflation and slower growth.

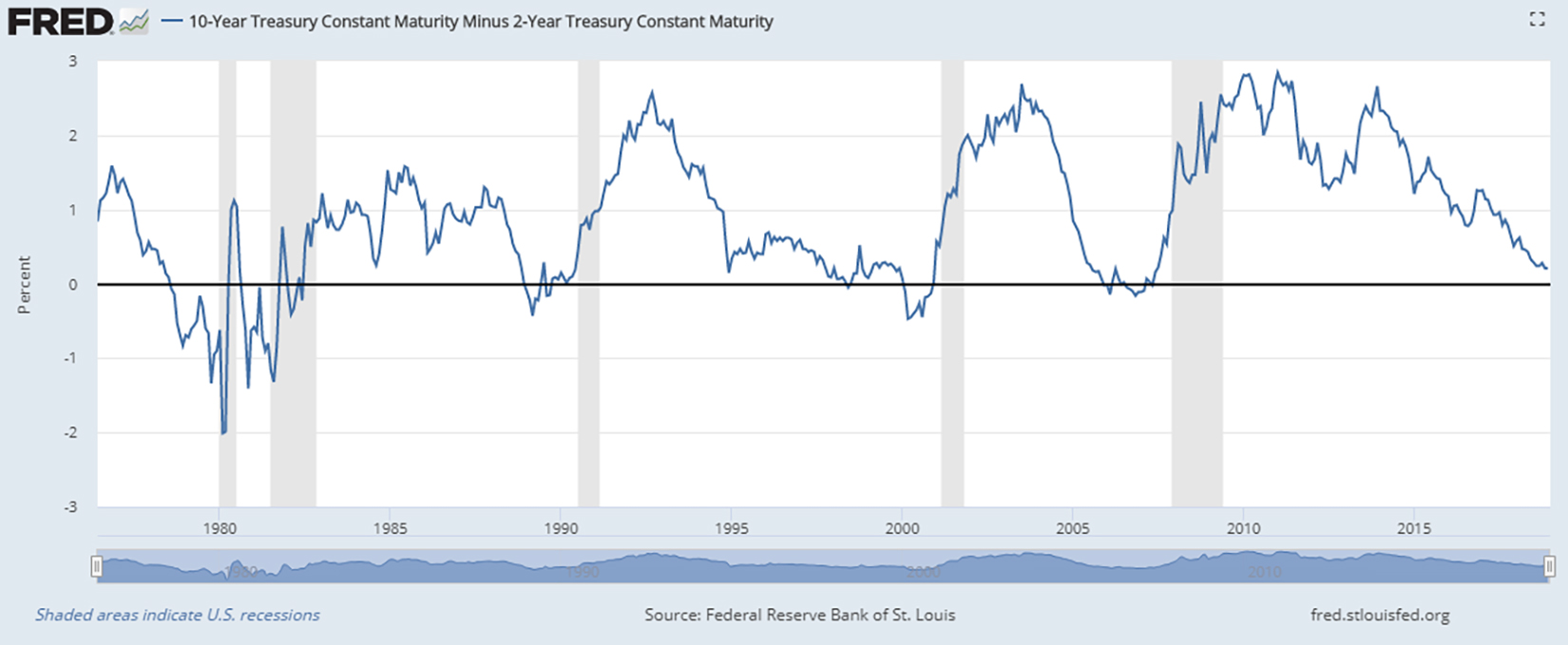

In 2018, the Treasury yield curve flattened with short-term rates near long-term rates and briefly inverted for the first time in more than a decade as 2-year yields rose above 5-year yields. An inverted yield curve – with short-term rates exceeding long-term ones – preceded every recession in the past 60 years. Though, not every instance of an inverted yield curve has resulted in recession. If the yield curve continues to invert in 2019, we expect the odds of recession to increase heading into 2020.

Regional economic outlooks

Kansas: Growth lagging U.S.

We expect modest growth to continue in the Kansas economy, albeit at a slower rate than the U.S. Last year, the Kansas unemployment rate fell to the lowest reading in nearly 20 years and stayed below the overall U.S. unemployment rate. We expect the unemployment rate in Kansas to remain at low levels in 2019. Professional and business service; manufacturing; and trade, transportation and utility jobs experienced healthy increases in Kansas last year and are anticipated to show continued strength this year.

Over-the-year changes in employment on nonfarm payrolls and employment by major industry

The rural economy has struggled in recent years with nearly half of all Kansas farmers experiencing a fourth consecutive year of losses in 2018. A mild strengthening in crop prices is expected, but livestock prices may trend slightly lower. Rising borrowing costs, high inventory levels, and concerns over a protracted trade war will likely continue constraining Kansas agriculture in 2019.

The Wichita economy saw jobs lost in 2017, but improved last year. Job growth is expected to trend slightly higher in 2019, buoyed by manufacturing and professional services. We anticipate the Wichita economy to expand this year, but grow at slower rate than the U.S. and the majority of metro areas. Business/consumer optimism and aerospace demand should help power the local economy; however, trade issues, commodity prices, lack of skilled labor, and slow population growth will likely limit growth in southeast Kansas.

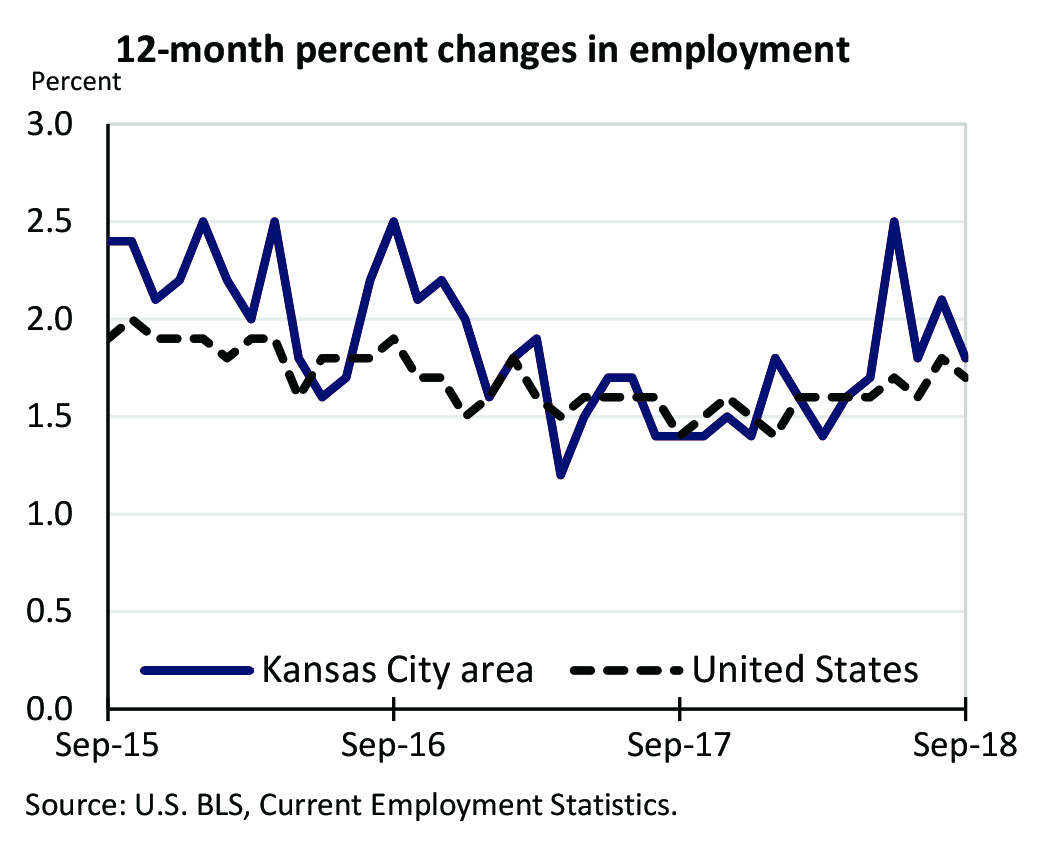

Northeast Kansas and Metro Kansas City area experienced a lower unemployment rate and tighter labor conditions than the U.S. last year. In 2019, these trends will likely continue, placing growth constraints on local employers looking to hire qualified workers. Area labor growth in 2018 was fueled by professional services, trade/transportation and construction. We expect labor growth in these industries to remain strong this year. Given the economic diversity of Metro KC, economic growth in the region typically parallels U.S. economic conditions. If this trend persists, the area should expect moderate, but slowing growth in 2019.

Over-the-year changes in employment on nonfarm payrolls and employment by major industry

Oklahoma City Region: Energy price concerns

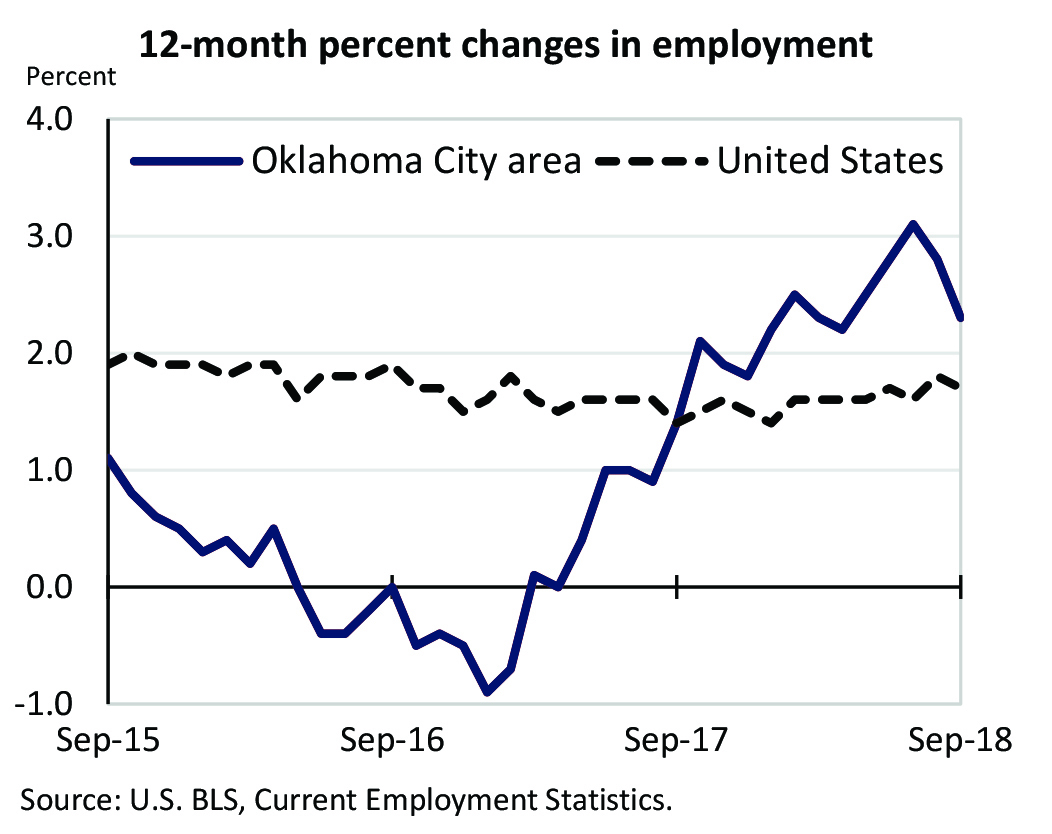

Similar to the Metro KC area, the Oklahoma City area witnessed very tight labor conditions and a low unemployment rate in 2018. Labor growth was led by energy, leisure/hospitality, construction, and professional services. However, unlike the Metro KC area, OKC is less economically diversified and has a greater sensitivity to energy price swings. For example, in late 2015 and 2016 when oil prices dropped, overall employment growth in OKC turned negative. Energy prices again fell in late 2018 below $50 per barrel. Moreover, we believe the generally accepted breakeven price of oil at $50 per barrel is understated, whereas a more reasonable breakeven price for many regional producers is probably closer to $60 per barrel, or higher. If the trend in lower oil prices continues, OKC economic growth could be hampered in 2019.

Over-the-year changes in employment on nonfarm payrolls and employment by major industry

Five factors that may impact our national and regional outlooks

Although we view recession probability to be low in 2019, a number of factors could cause economic activity to slow more than expected. Five of these factors that we identified are highlighted below:

Tighter financial conditions — In this scenario, the Fed increases rates more aggressively than anticipated. Business and consumer borrowing costs increase, demand softens, and short-term rates exceed longer-term ones. If this overshoot in monetary policy occurs, odds of a recession in 2020 increase significantly.

Trade war escalation — Trade tensions with China thus far have minimally impacted the U.S. economy. However, if the trade truce struck in December between the U.S. and China unravels, trade war issues may extend beyond tariffs to quantitative restrictions, boycotts, and significant retaliations from China. Under this scenario, impact to GDP could be 1% or more.

Financial stability risks — Market volatility increased and financial asset prices fell in the last quarter of 2018. If these trends persist, consumer confidence could wane and financial wealth decline, potentially stalling out economic growth in 2019. Also, an emerging market debt crisis could materialize if trade wars escalate, the U.S. dollar remains strong, or the global economy slows more than anticipated. The past two recessions were preceded by destabilization in financial markets, rather than runaway inflation.

China’s economy falters — The Chinese economy is the world’s second largest, only trailing the U.S. in global output. Similar to the U.S. economic trend, China’s economy is expected to slow in 2019. However, if Chinese policymakers fail to provide sufficient stimulus or China-U.S. relations deteriorate further, a hard economic landing may be in store for China. Such a scenario would likely lead to a broader global slowdown, impacting the U.S. and many other economies.

Eurozone/UK political risks — Escalation in fiscal tensions between European leaders and the Italian government could prompt Italy’s exit from the Euro. If this occurs, a wider crisis in the Eurozone could emerge and more countries may exit the Euro. Also, uncertainties related to Brexit may further weigh upon the United Kingdom’s economy and, to a lesser extent, Europe’s. However, Brexit-related risks may be less impactful to the global economy than a broader Eurozone breakup.

Investment outlook: Continued volatility

Given our outlook of slowing growth and higher capital costs, last year’s market volatility may spillover into 2019. Our long-term expectations for global stocks and bonds is more subdued than historical returns in light of current valuations, a potential slowdown in corporate earnings, and low risk-free rates. Moreover, downside risks appear greater for equities and high yield bonds than high-quality fixed income. Developed international market valuations seem more favorable than U.S. equities. However, geopolitical risks and slower growth expectations may impact near-term performance of international stocks. Inflation-sensitive assets normally perform well toward the end of economic expansions, but may underperform historical norms in this late cycle as the risk of high inflation appears unlikely. Overall, investment expectations should be tempered, as few asset classes look cheap at the start of 2019.

Investment strategy: Understand risk and focus on controllable factors

In closing, our focus in 2019 continues to be on the construction of financial solutions designed to deliver a financial plan aligned with a clients’ values, objectives and goals.

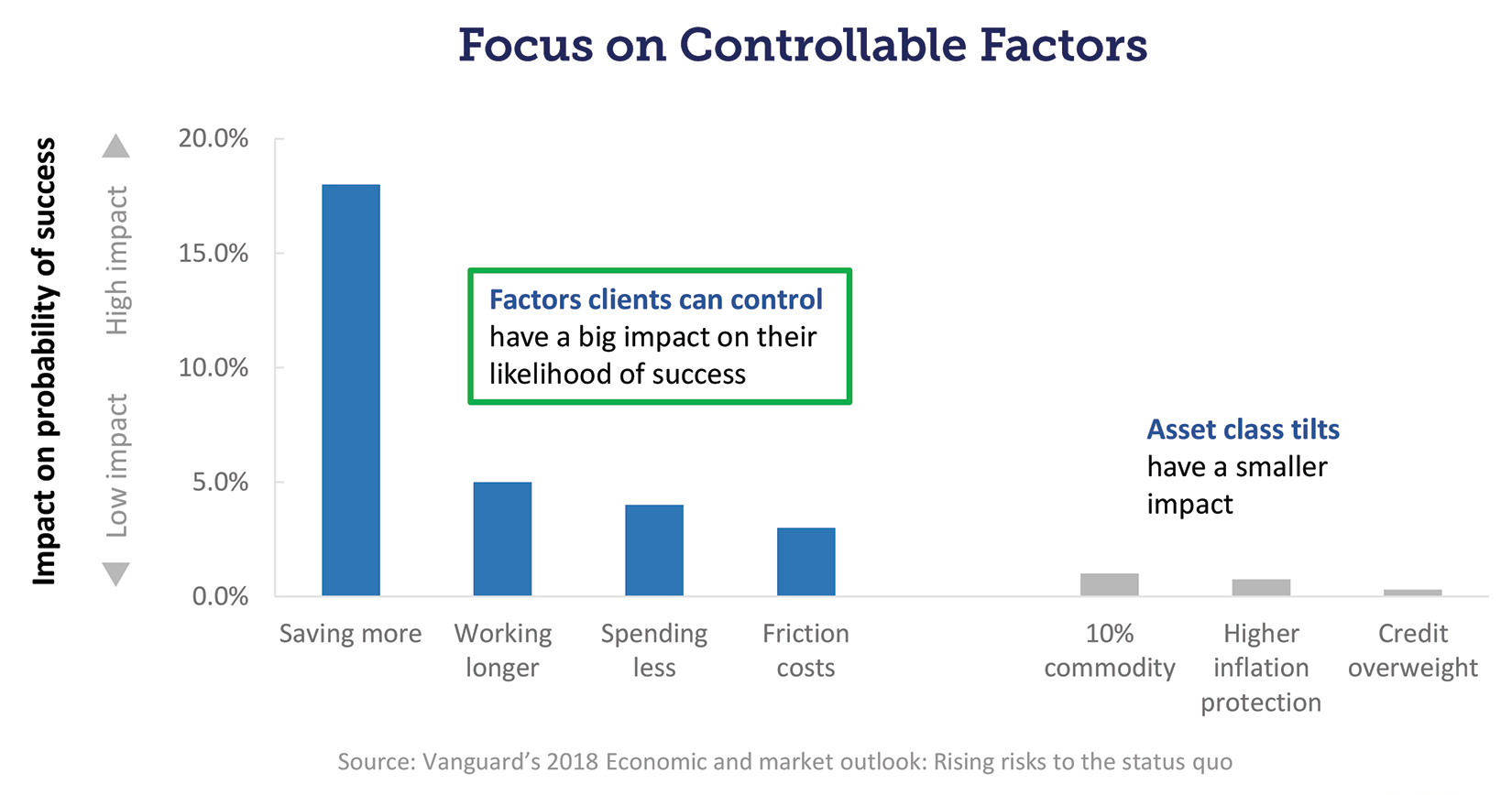

Considering our investment outlook for ongoing volatility and low return expectations, we believe it is crucial for investors to understand their willingness and capacity for risk and to focus on factors within their control when making investment decisions.

Comprehensive risk analysis helps investors clarify how much risk is needed, how much risk can be afforded, and how much risk can be stomached. Past responses to market selloffs may indicate an investor’s risk willingness – were assets sold, held, or purchased? By recalling past behaviors or assessing how one might likely respond, investors can determine if they are assuming more risk than they can reasonably tolerate. Also, risk capacity – the maximum level of risk one can afford to take to fund financial goals – should be considered. Financial planning tools can help determine an investor’s risk capacity. By assessing both risk willingness and financial capacity, portfolios can be optimized to achieve an investor’s goals, while constrained by an investor’s risk willingness.

Furthermore, research shows that factors within an investor’s control – such as adhering to a disciplined investment process, saving more, working longer, spending less, and minimizing friction costs (e.g. taxes) – far outweigh the less reliable benefits of shifting portfolio allocations. Based on our experience, investors who focus on these controllable factors tend to reach their financial goals more consistently than investors who attempt to time the market. Adhering to these time-tested principles will be vital for investors in 2019. Ultimately, we believe disciplined, patient investors are likely to be rewarded over the long term despite a subdued market outlook.

The INTRUST Market Perspectives are the consensus of the INTRUST Bank, N.A. (“INTRUST”) Wealth Investment Strategy team and are based on third party sources believed to be reliable. INTRUST has relied upon and assumed, without independent verification, the accuracy and completeness of this third party information.

INTRUST makes no warranties with regard to the information or results obtained by its use and disclaims any and all liability arising out of the use of, or reliance on the information.

The information presented has been prepared for informational purposes only. It should not be relied upon as a recommendation to buy or sell securities or to participate in any investment strategy. The Investment Outlook is not intended to, and should not, form a primary basis for any investment decisions. This information should not be construed as investment, legal, tax or accounting advice. Past performance is no guarantee of future results.

| Not FDIC Insured | No Bank Guarantee | May Lose Value |

Posted:

01/17/2019

Category:

Recommended Articles

.png?Status=Temp&sfvrsn=91c53d6b_2)