Personal Banking

2017 Economic Outlook

Economic Themes

The aging US economic expansion, now in its eighth year, likely becomes the third longest since World War II.

US Economic Growth: We forecast a continuation of GDP growth as our baseline scenario, fueled by consumer strength and potential infrastructure spending. However, economic expansion will likely persist at a slower than historical pace due to mediocre global demand and a strong US dollar.

US Inflation and FED Policy: We expect more upward pressure to inflation. Potential increases to wage and energy costs may contribute to these pressures. The Federal Reserve will attempt to balance economic growth and inflation with policy rate adjustments. Accordingly, we forecast a continuation of rising rates in 2017, but the pace of increases will likely remain below historical norms.

US Labor Market: We anticipate continued strength in the labor market driven by economic growth and the new administration’s nationalism ideology and considerations for a more pro-business regulatory environment. However, the downward trend in the unemployment rate may be tempered by an increase in previously discouraged workers reentering the labor market.

US Regional Markets: On a local and regional basis, we see improving opportunities in manufacturing, commercial development, and services. The energy sector also appears favorable, as further increases in the price of oil and gas should lead to renewed drilling activity. However, agriculture may face headwinds in 2017 due to an oversupply of grain across the country and reduced prices in proteins (e.g. cattle, dairy, hogs and poultry). Non-farm payrolls in Kansas are forecasted to grow around 1% in 2017.

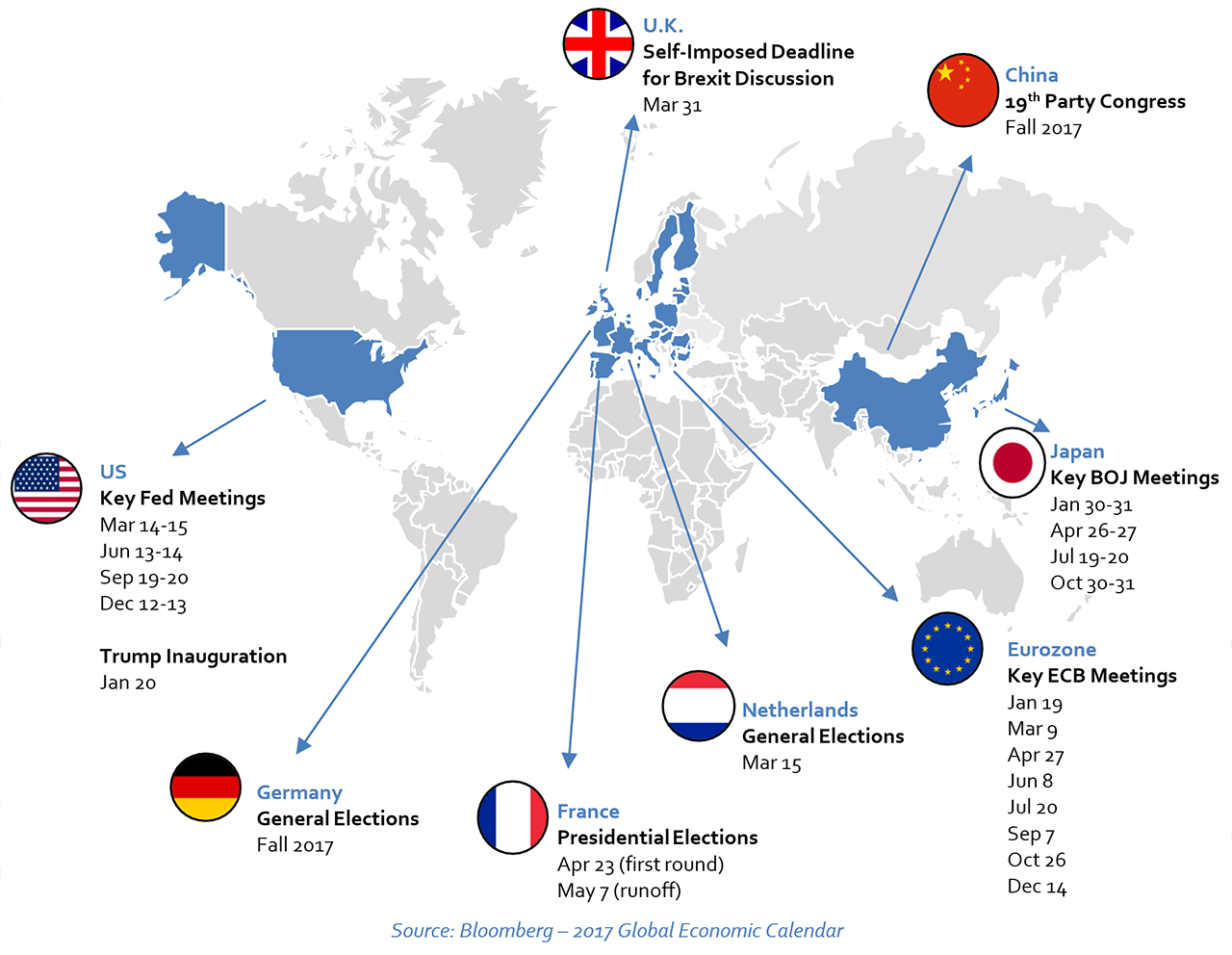

International Economic Growth: We forecast that fiscal and monetary policy likely will continue on a divergent path globally in accordance with economic strength. The Eurozone may see more rate decreases, while the US should experience a continuation of policy rate increases. The Eurozone will likely have muted but positive GDP growth, as these economies absorb economic stimulus and face a rise in nationalism. In Asia, China’s GDP may further slow, but Japan’s growth should strengthen due to fiscal stimulus and a weakened yen. Given the Trump Administration’s bias toward trade barriers, Emerging Markets may remain volatile.

Factors That May Impact Our Outlook

The distribution of potential economic outcomes are wider than recent periods, given the multitude of scheduled geopolitical events in 2017.

Potential Downside Risks

Export / Import Headwind: A continuation in the strength of the US Dollar may negatively impact trade balances as exports become challenged and imports appear more attractive.

Trade Barriers: Potential political disruption in the Eurozone, a movement towards nationalism and possible changes to NAFTA and TPP could limit trade opportunities.

Overheating US Economy: With continued strength in the labor market, extraordinary inflationary pressures cannot be ruled out. In this scenario, Policy Rate hikes may occur at a faster-than-anticipated rate to combat inflation and increase recession odds.

Potential Upside Considerations

US Regulation: Tax and legislative reforms, potential repatriation of offshore dollars and relaxed regulatory policies (if enacted) may provide a more favorable business climate that potentially leads to stronger growth in the private sector.

US Dollar Stabilization: A strong Dollar makes international products and services cheaper to US consumers and businesses, prompting more imports and reversing the fund flow trend. In this scenario, further Dollar strengthening is mitigated, providing a better export environment for US companies.

OPEC Surprises: OPEC’s decision to cut supply in late 2016 provides a favorable backdrop for oil price increases. There is, however, no guarantee that these supply cut “promises” will remain in place, leading to potentially lower energy costs that could boost economic output.

Market Implications

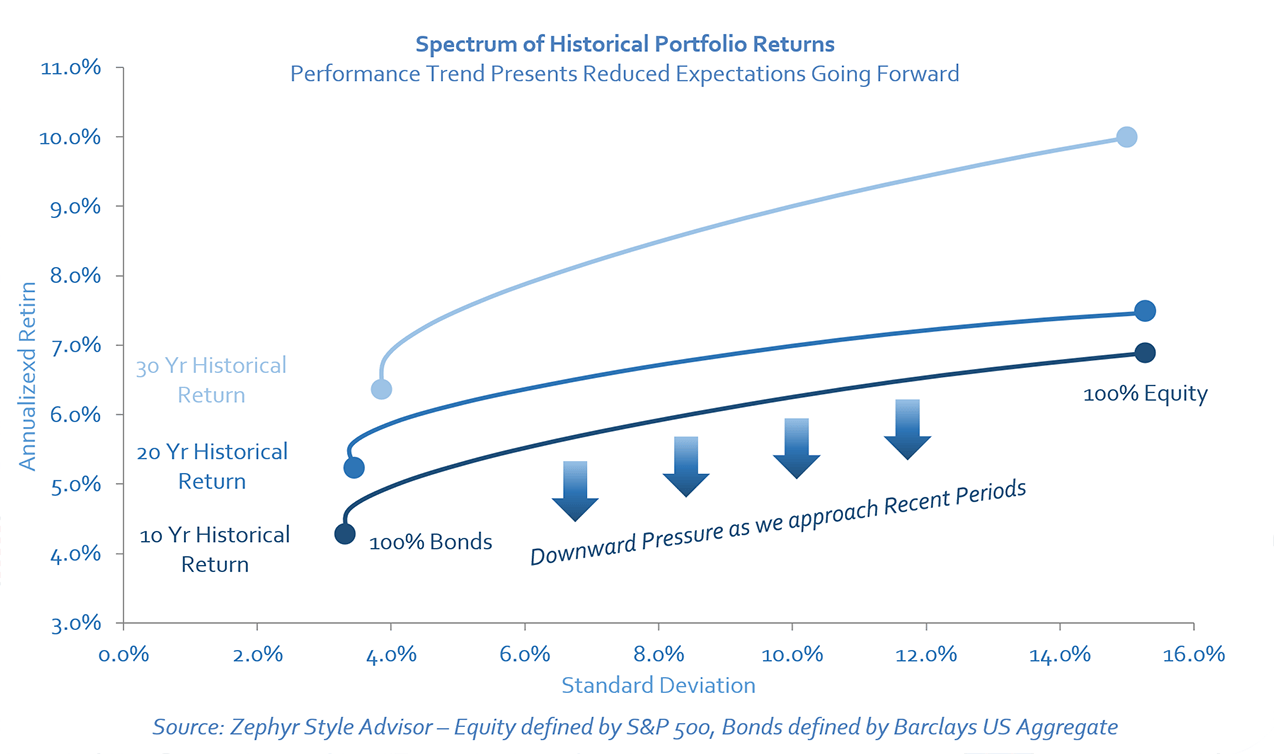

Our baseline economic backdrop is more favorable for equities than fixed income, and long-term asset class returns may continue trending below historical averages.

Equities: Our forecast for an expansionary economic environment with limited recessionary risks suggests US equities may continue to advance. However, potential corporate profit growth may be offset by lower price-earnings ratios amid higher interest rates. Valuations of developed international stocks appear reasonably attractive, as many of these markets have not appreciated to the same extent as the US equity markets have since 2009. Still, geopolitical uncertainty remains a concern and may impact near-term performance of international equities.

Fixed Income: We believe bonds may face headwinds as the economy continues to reflate. Overall, Fed rate increases will likely impact short rates, while the prospects of a strengthening economic backdrop may put upward pressure on longer-term rates. Corporate and high yield bonds may benefit from a more favorable business environment, but any gains likely will be muted by rising rates. National municipal bonds may be negatively impacted by potentially lower federal income tax rates, but municipals could benefit from infrastructure spending. On a regional basis, Kansas municipals may benefit from potentially higher tax rates in the state.

Alternative Investments: We expect alternative assets to play an increasingly important role for investors, as both equities and fixed income face the potential of lower-than-historical returns. With respect to Real Assets, the environment may be favorable for energy, commodities and Treasury Inflation Protected Securities, but less so for Real Estate in the wake of higher interest rates. Absolute Return strategies may benefit from market volatility and dispersion of returns across asset classes and currencies. Furthermore, Private Equity may continue to provide outsized returns for qualified investors who are willing and able to withstand the illiquidity of the asset class.

Portfolio Implications

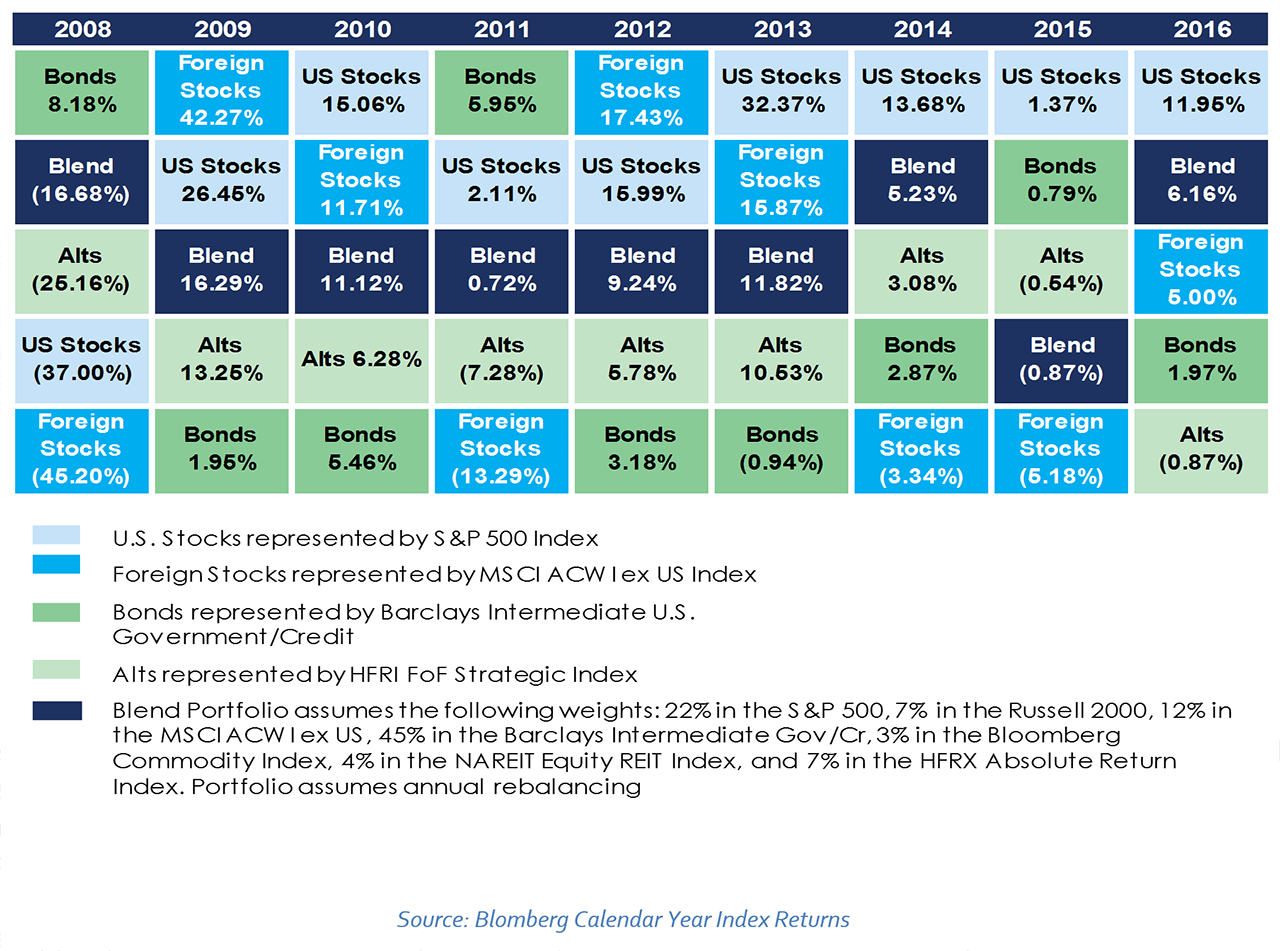

Given the uncertainty that lies ahead, broad diversification should continue to provide downside protection and help to preserve wealth.

Diversification Benefits Reemerge: After an extended period of outperformance from US large cap stocks, we believe diversification may finally be rewarded. The reduction in government intervention and normalization of interest rates may allow a broader array of asset classes to benefit in this new environment.

Avoid Chasing Yield: Investors should resist the temptation to overstretch for yield in the wake of potential interest rate risk. A prudent approach may be to position fixed income allocations with shorter maturities and higher-quality holdings, emphasizing total return more than yield.

Alternative Strategies Present Key Differentiating Characteristics: Alternative Investment solutions may help to increase returns and reduce portfolio risk amid lower return expectations for equities and fixed income. Absolute Return investments can help augment fixed income allocations, by providing diversification benefits and potentially enhancing returns. Real Return strategies can help protect against potential inflation shocks. For qualified investors, Private Equity investments may help enhance a portfolio’s long-term return potential.

Integrate Goals-based Investing and Tax-smart Strategies: With lower return expectations across many asset classes, managing returns through smart tax management and goals-based investing becomes a crucial part of successful portfolio construction. We believe clients should align their wealth with their goals and work with trusted advisors to construct holistic portfolios built for long-term goal attainment.

The INTRUST 2017 Economic and Market Perspectives is a consensus of divisions within INTRUST Bank, N.A. ("INTRUST") and is based on third party sources believed to be reliable. INTRUST has relied upon and assumed without independent verification the accuracy of this third party information.

INTRUST makes no warranties with regard to the information or results obtained by its use and disclaims any and all liability arising out of the use of, or reliance on the information.

The information presented has been prepared for informational purposes only. It should not be relied upon as a recommendation to buy or sell securities or to participate in any investment strategy. The Economic and Market Outlook is not intended, and should not, form a primary basis for any investment decisions. This information should not be construed as investment, legal, tax or accounting advice. Past performance is no guarantee of future results.

| Not FDIC Insured | No Bank Guarantee | May Lose Value |

Recommended Articles

.png?Status=Temp&sfvrsn=91c53d6b_2)