Personal Banking

Quarterly Perspectives - Third Quarter 2019

Global Economics and the Goals-Based Investor

Theme: Economies across the globe are showing signs of slowing and many investors are looking for implications for the U.S. economy and investment portfolios. Parts of the U.S. economy are slowing, but the broader economy remains strong. Economic global slowdown will likely lead to recessionary environment in some major developed economies, but recession is less likely in the U.S. in the near term.

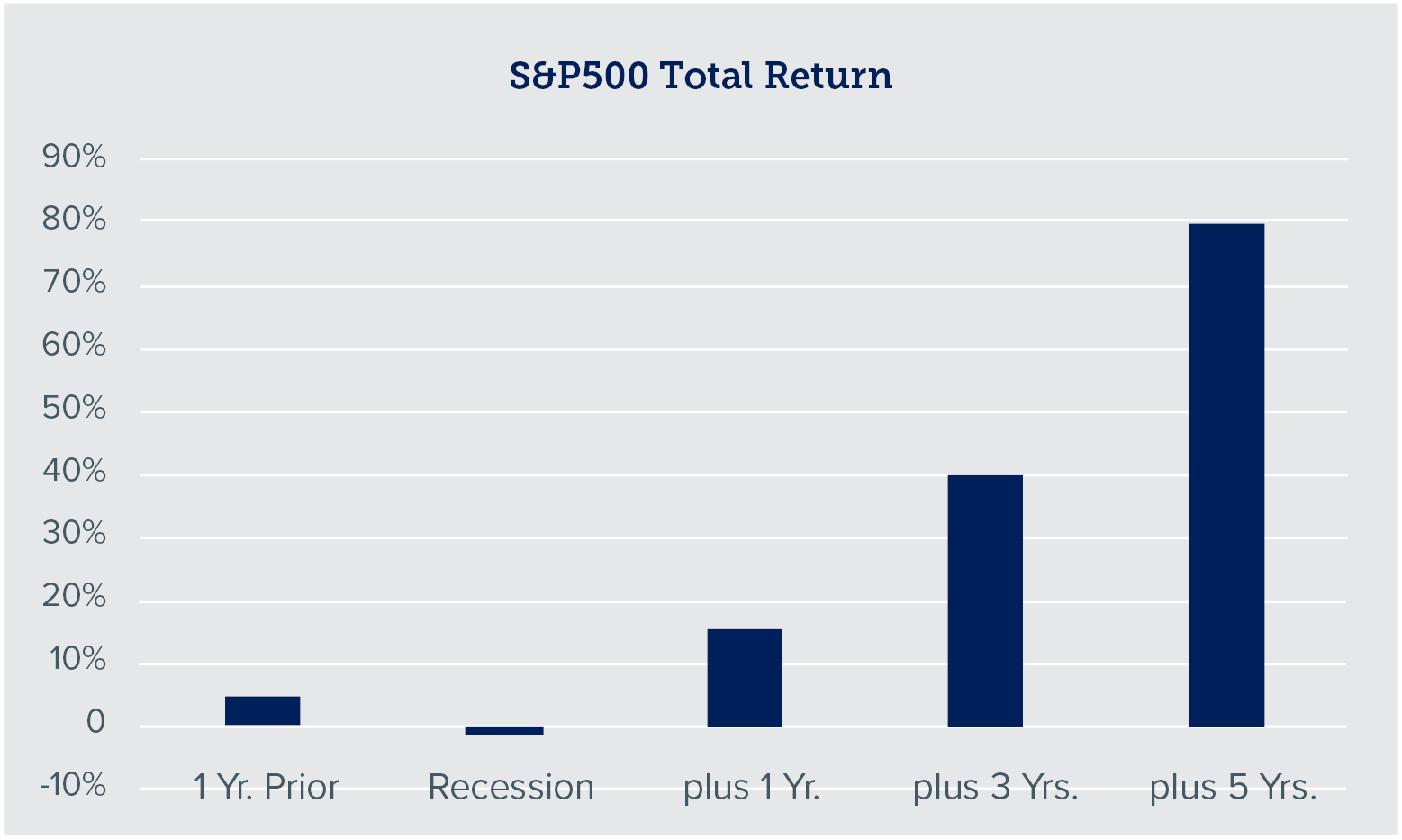

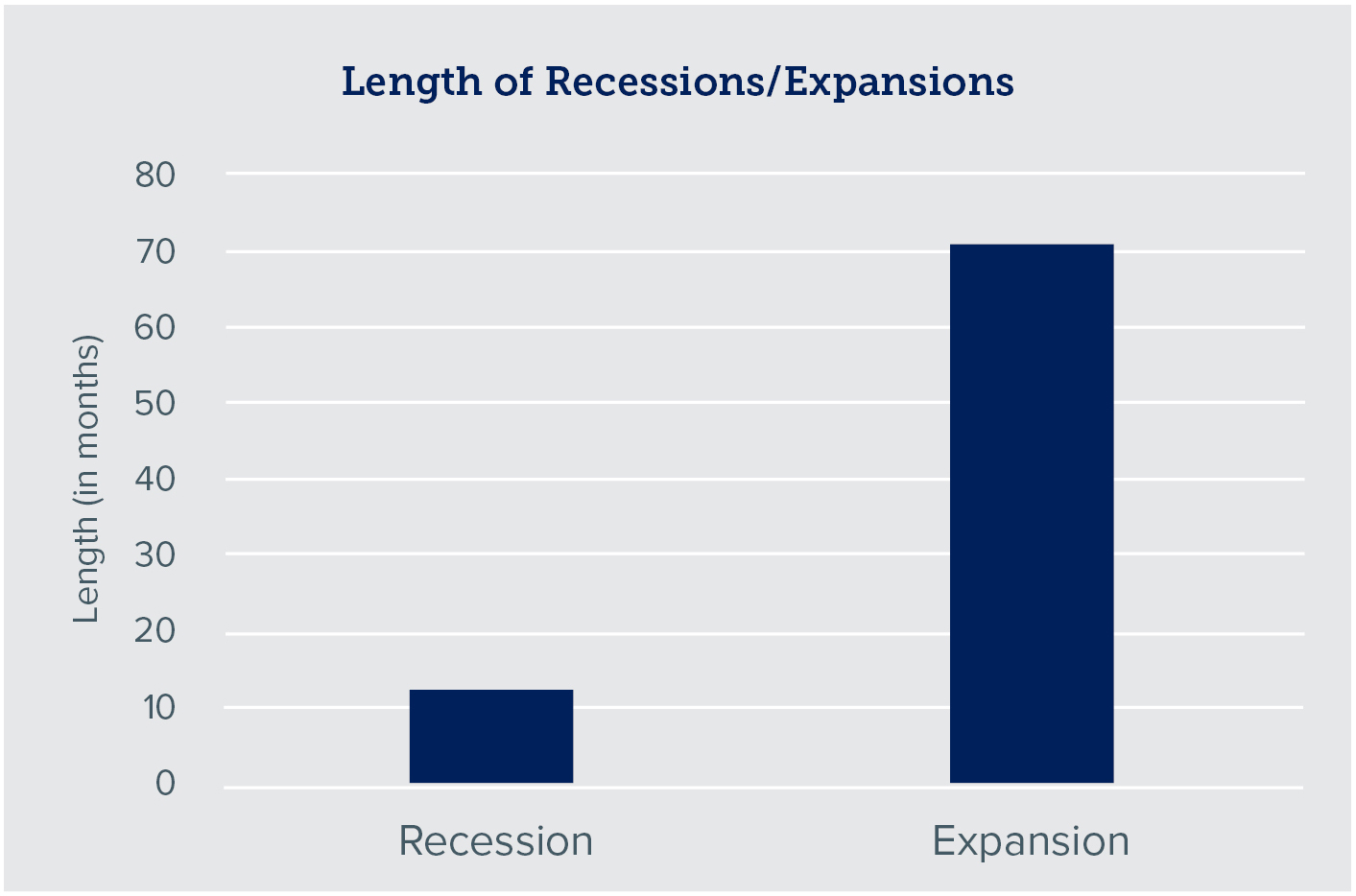

As we noted in our Quarterly Perspectives — First Quarter 2019, periods of economic recession do not always coincide with market corrections. During times of economic uncertainty and market volatility, the intelligent investor is rewarded for understanding the risk and focusing on controllable factors - such as adhering to a disciplined investment process, saving more, working longer, spending less and minimizing the impact of taxes.

U.S. Consumer Remains Strong

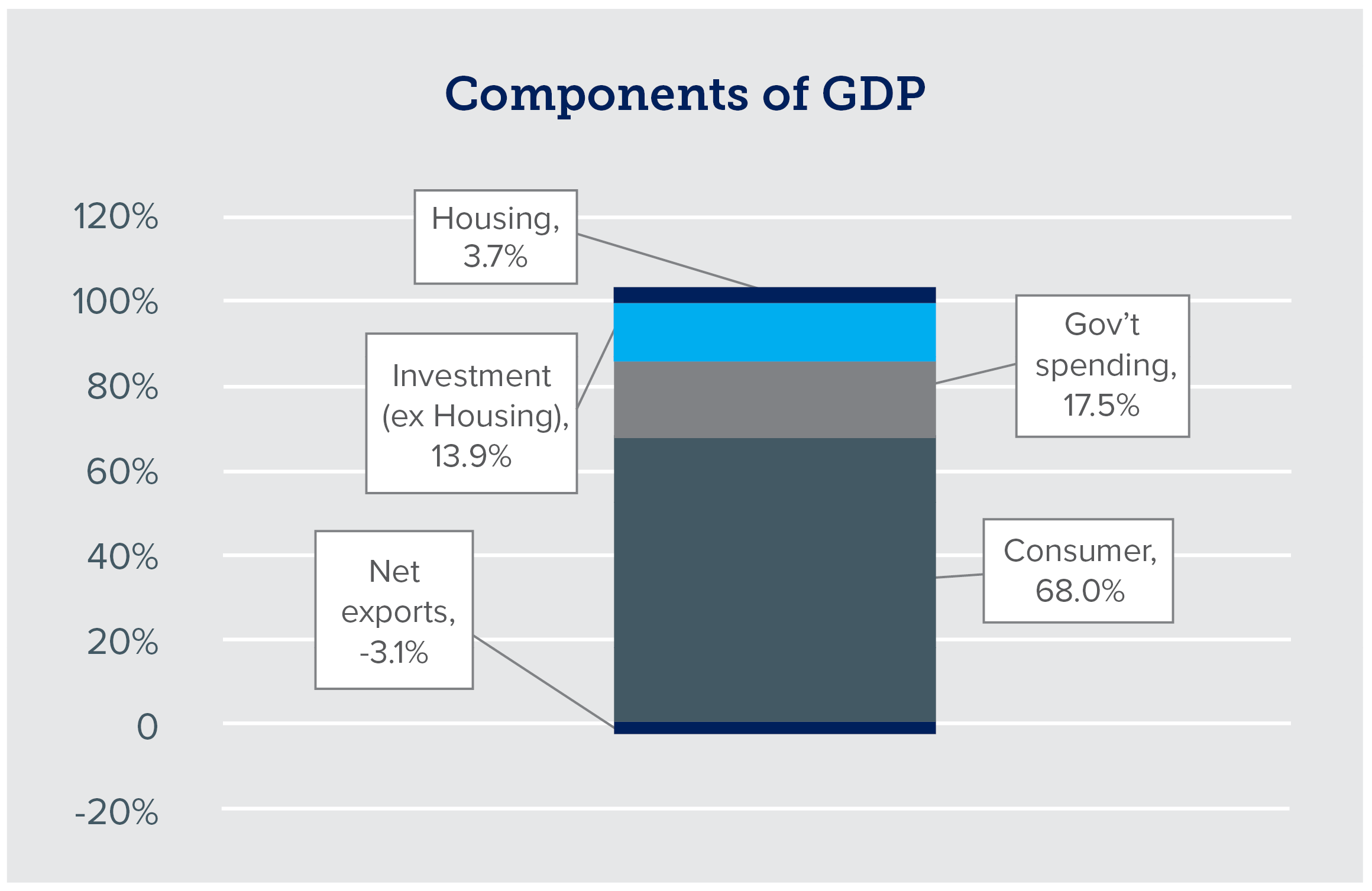

- U.S. Consumer — fuel for 70% of GDP — remains strong and resilient in the face of mixed economic signals

- U.S. household balance sheets appear much stronger than the period leading into the last recession

Watching Economic Policy Trends

- Global central bank actions of reducing rates indicate concern that various economies are slowing too much

- Trade tariffs are disrupting supply chains and are acting as a drag on global GDP

- U.S. politics heading into an election year are acrimonious (at best) and are fueling market uncertainty on the direction and degree of government intervention

Economy/Financial Markets

- The U.S. economy, which is largely fueled by consumer spending, continues to expand in the midst of a lower interest rate environment, benign inflation, historically low unemployment rates and moderate wage growth.

- GDP growth should continue to decelerate, indicative of a late-stage business cycle. Fed action will likely pivot to accommodative policies in order to encourage continued economic expansion.

- Political uncertainties will likely continue to contribute to volatility as financial markets respond to short-term headline issues; areas of uncertainty include Brexit, political turmoil in Hong Kong, upcoming U.S. elections, immigration policy changes and continued global trade negotiations.

Growth Assets

- Equities continue to provide an attractive investment option as low yields in the bond markets make dividend-paying stocks more attractive

- Favorable administrative policies should continue to fuel earnings growth in the short term, providing a foundation for equity valuations

- Developed and Emerging Markets have been hampered by protectionist U.S. trade policies and will be affected by the strength of the U.S. Dollar; as market volatility and the strength of the U.S. Dollar return to more normalized levels, a diversified portfolio may play an increasingly important role in supporting returns and risk exposure

Defensive Assets

- Recent deterioration in yields has resulted in lowered return forecasts for bonds as high demand for U.S. sovereign debt continues under pressure from the yield-starved global bond market

- Bonds will continue to provide consistent income and lowered volatility to portfolios

- Prudent investors should avoid the temptation to reach for yield by positioning portfolios with shorter maturities and higher quality, emphasizing total return over yield

The INTRUST Market Perspectives are the consensus of the INTRUST Investment Strategy team and are based on third party sources believed to be reliable. INTRUST has relied upon and assumed, without independent verification, the accuracy and completeness of this third party information.

INTRUST makes no warranties with regard to the information or results obtained by its use and disclaims any and all liability arising out of the use of, or reliance on the information.

The information presented has been prepared for informational purposes only. It should not be relied upon as a recommendation to buy or sell securities or to participate in any investment strategy. The Forward–Looking Perspectives are not intended to, and should not, form a primary basis for any investment decisions. This information should not be construed as investment, legal, tax or accounting advice. Past performance is no guarantee of future results.

| Not FDIC Insured | No Bank Guarantee | May Lose Value |

Recommended Articles

.png?Status=Temp&sfvrsn=91c53d6b_2)