Our History

Pioneering principles.

1883 - 1940

The lineage we belong to stretches back to those very first days of the last century. Not just a line of time and history, but an unbreakable cord tied to our founding principles.

At age 18, C.Q. Chandler II purchases one-half ownership in Elk City Bank. Over the next 40 years, C.Q., along with other family members, would either start or purchase control of almost 60 banks in five states.

A search for a centrally located bank leads C.Q. to Wichita, where he takes the helm of Kansas National Bank.

C.Q. buys the first automobile sold in Wichita. The 1902 Oldsmobile allows him to continue doing business face-to-face as the bank grows throughout south-central Kansas.

The cattle industry dominates the Kansas economy, thanks in part to C.Q.'s considerable efforts in helping local ranchers succeed.

"I have loaned money on cattle for 15 years, and I consider no security in the West better," he wrote at the time.

After his daughter suffered a debilitating illness that left her temporarily unable to walk, C.Q. encourages an orthopedic specialist to relocate to Wichita from the East coast and founds the Wichita Orthopedic Clinic. Realizing, too, that many local children with disabilities don't have the funds necessary to receive the care they desperately need, C.Q. organizes what is now known as the Kansas Society for Children with Challenges. The work he started with KSCC continues through each generation of bank leadership and is still going strong today.

The bank begins a partnership with the Community Chest, now known as the United Way, offering time, expertise and financial support to help the organization provide financial assistance, counseling and healthcare to those in need. The relationship continues today, with a high percentage of bank employees pledging annual support.

1928

Charles J. “C.J.” Chandler comes to his father’s bank after gaining experience at the First State Bank in Gage, Oklahoma, a Chandler family-owned bank. C.J. becomes president of First National Bank in Wichita in 1943.

Growing customer service.

1945 - 1994

We’ve never developed a new technology just for the sake of being first, nor followed a business practice because it was trendy. We check every innovation against our fundamental values to make sure we’re staying true to ourselves and our customers.

Adapting quickly to the post-WWII consumer revolution, C.J. helps create a consumer loan department to provide customers with a way to pay for new cars, refrigerators and air conditioners in installments.

1950

C.Q. “Chuck” Chandler III joins First National Bank in Wichita as a correspondent banker, representing the third generation of the family to choose banking as a career.

To further the company’s focus on consumer needs – and efficiency – C.J. opens Wichita’s first drive-in bank with four cashier windows.

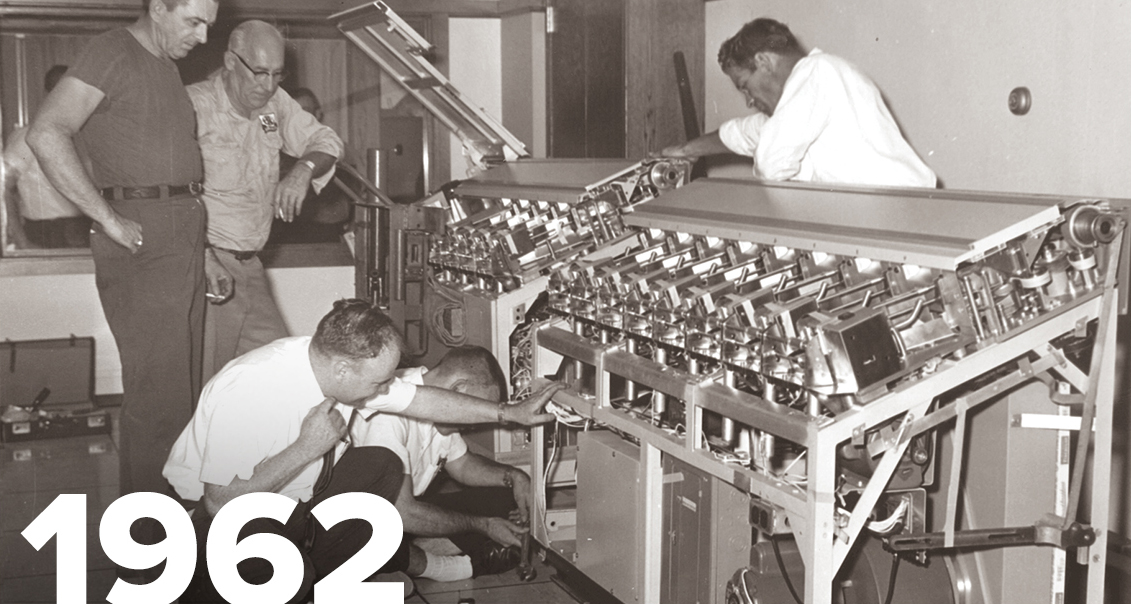

In a pioneering effort among Wichita banks, Chuck oversees the bank’s move to automate services, installing the company’s first computer system.

Chuck leads the bank’s move to deliver credit cards to customers in the late '60s, providing them with a new form of credit.

1971

Chuck Chandler becomes president of the bank. Chuck ushers in electronic banking and cash management and expands credit card usage and acceptance. He also leads the bank to adopt a more liberal approach in support of Small Business Administration ventures, making INTRUST one of the leading small-business lenders in the region.

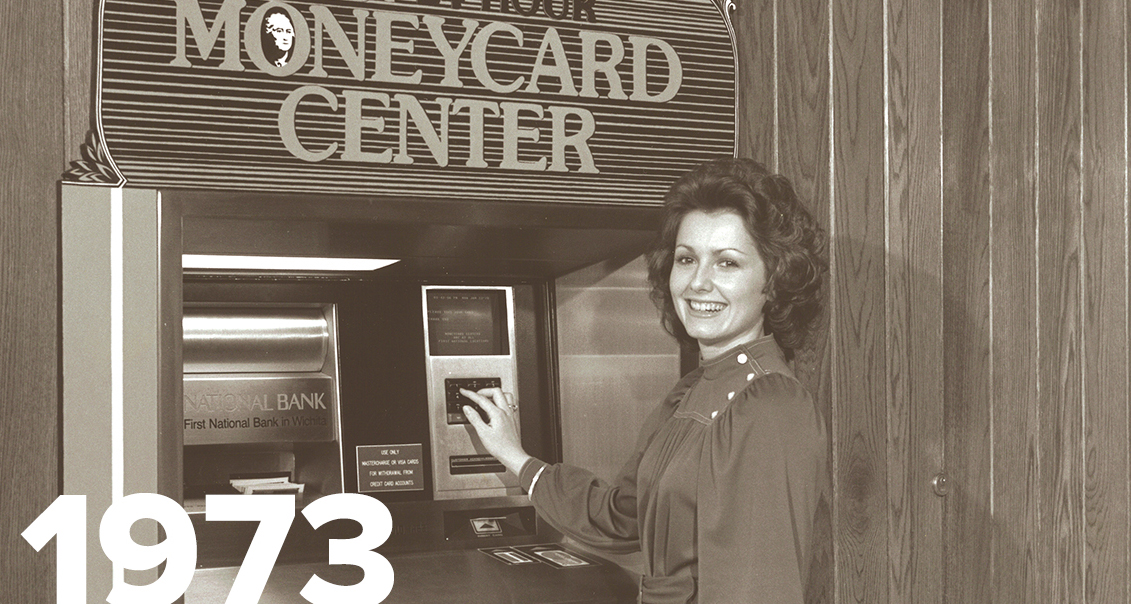

To thrive in an increasingly competitive market, Chuck moves deliberately to install the first completely automated teller machine in Kansas. While not meant to replace the judgment of a seasoned teller, it has become the way most people access cash.

Chuck also announces the company’s first branches – the first step toward becoming the bank with the most locations in Wichita. Designed as neighborhood branches to serve east and west Wichita, these locations are still operating today.

After securing degrees from Kansas State and Northwestern universities, C.Q. “Charlie” Chandler IV joins the bank to begin a career that continues to this day.

Grocery store banking, a novel concept at the time, is welcomed by customers when the bank opens its first in-store location in Dillons. Small business customers, in particular, have come to appreciate the evening deposit option, making it easier to run their companies.

1992

Becoming the first Kansas financial entity to announce plans to acquire an out-of-state bank, the company purchases Will Rogers Bank in Oklahoma.

The First National Bank in Wichita changes its name to INTRUST Bank. As Chuck states at the time, “INTRUST uniquely fits the way we do business; a tradition of trust has been our legacy for over 100 years.”

In July, the bank celebrates a successful merger with Kansas State Bank & Trust, bringing company assets to $1.25 billion, with 20 locations and 35 ATMs.

Continuous innovation.

1997 - present

With our time-tested founding principles guiding our course, we continue our progress into the future. As the pace of change accelerates, so does the pace of our growth and innovation.

1997

Charlie becomes president of INTRUST Bank in 1996 and leads the company into the internet age early with the launch of intrustbank.com. INTRUST is the first bank in Kansas to offer real-time online banking, furthering our tradition of innovative solutions for customers.

Under Charlie’s leadership, INTRUST Bank grows to become one of the largest independent banks headquartered in Kansas. INTRUST expands to the Manhattan, Topeka, Lawrence, Overland Park, Andover and Augusta communities through the acquisition of U.S. Bank’s Kansas locations in 1999.

INTRUST Bank is well-positioned during the great recession, counting on the strength and stability it has fostered for more than 100 years. As stated by Charlie in the annual report to shareholders, “INTRUST will remain a vital, resilient and steadfast part of our region’s landscape and a beacon of trust to those we serve – regardless of the economic times.”

The INTRUST Bank Arena opens in Wichita, attracting attendees from across the country and beyond to the 15,000-seat live event venue.

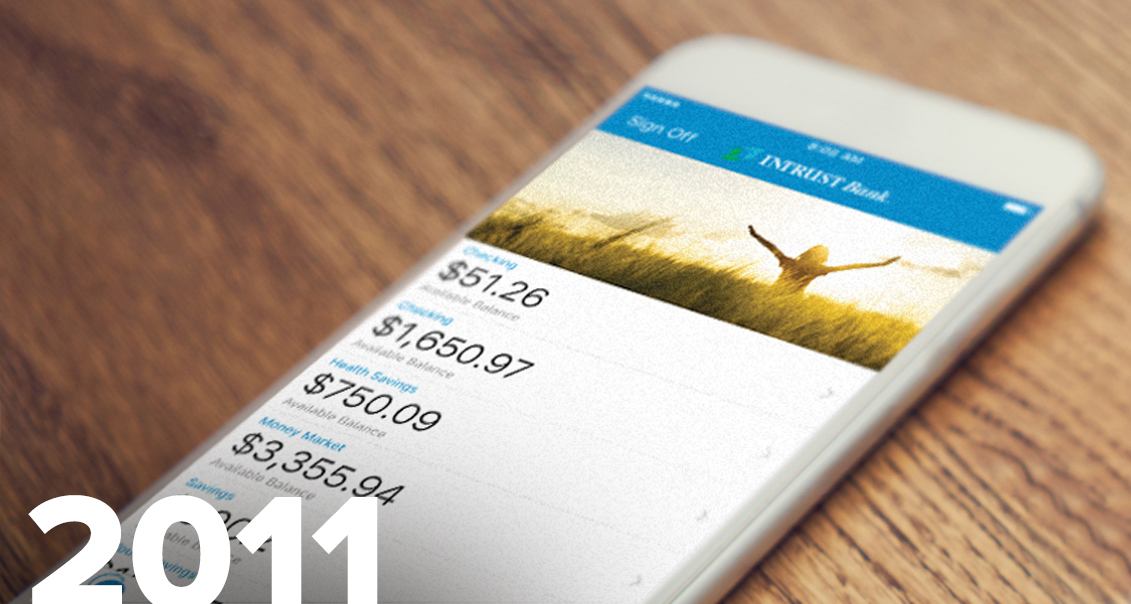

Mobile banking is introduced to a generation – and their grandparents – who have come to expect banking at their fingertips.

INTRUST continues our commitment to our founding principles and fundamental values. Our future relies on healthy and positive relationships with you, our customers and partners. The character qualities we strive for are the tools we use to earn your trust.

We hope you'll notice our commitment to these qualities with every interaction.

.png?Status=Temp&sfvrsn=91c53d6b_2)