Personal Banking

Quarterly Perspectives — First Quarter 2019

Recessions and the Goals-Based Investor

Theme: With the current US economic expansion quickly becoming the longest since WWII, many investors are asking for advice on what steps should be taken with their investment portfolios. Predicting the timing of recessions is difficult and attempts to re-allocate an investment portfolio to avoid market corrections are rarely successful. Rather, long-term investment success is driven primarily by factors within the investor’s control – adhering to a diversified portfolio that aligns with your risk profile and working consistently to reduce the negative impacts of taxes.

Recessions do not always mean poor market performance

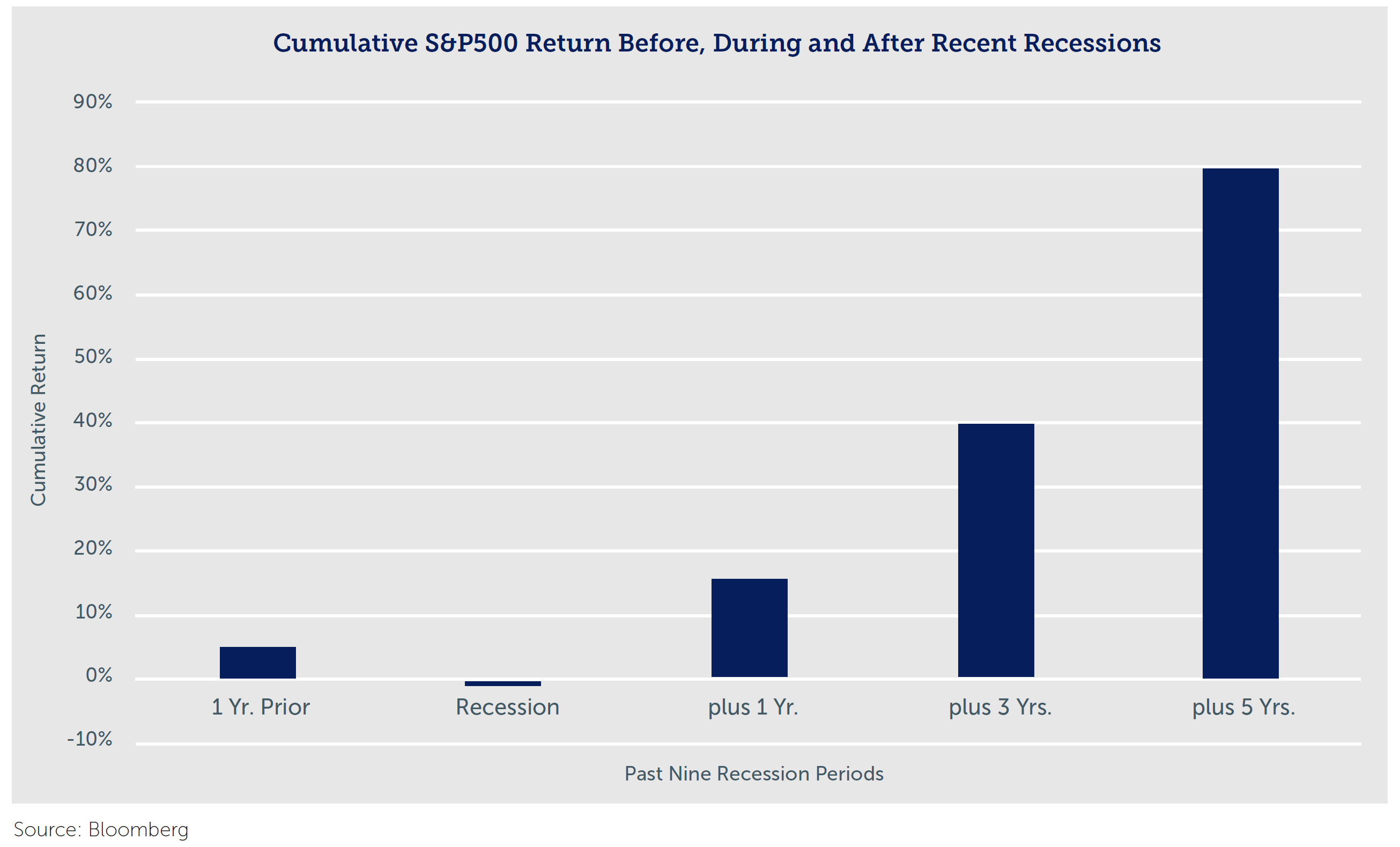

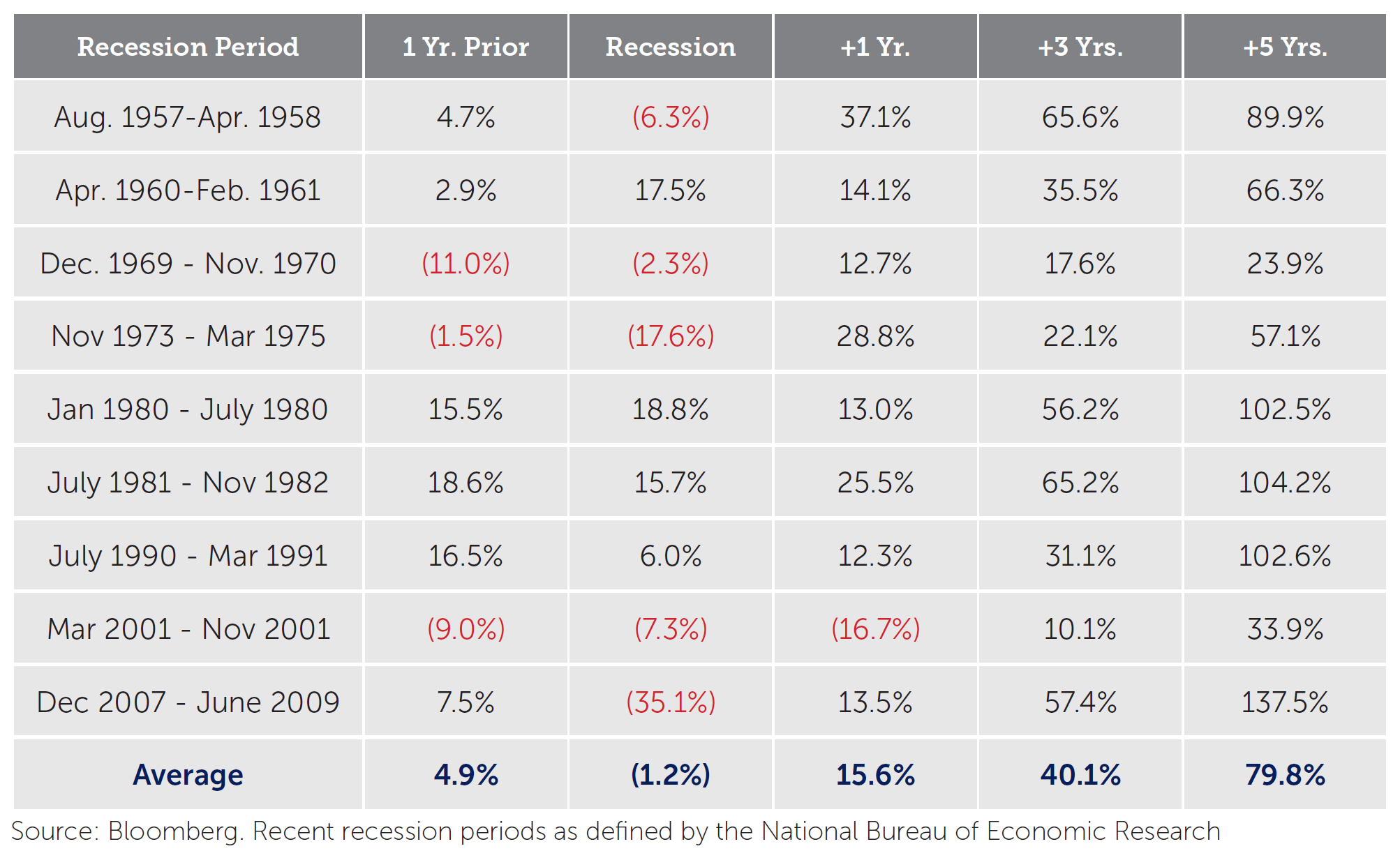

As shown in this table (and the graph above) of the S&P 500, periods of recessions do not always coincide with market corrections. In fact, stock market investments actually grew during several of the recent US economic recessions. An analysis of recent recessions shows that the patient investor who sticks with a consistent investment strategy is quickly rewarded.

Focus on the controllable

During times of market volatility, the intelligent investor is rewarded for understanding risk and focusing on controllable factors – such as adhering to a disciplined investment process, saving more, working longer, spending less, and minimizing the impact of taxes.

Economy/Financial Markets

- The US economy continued to expand through 2018. Even though in June the US economic expansion will become the longest since WWII, we are seeing signs of weakness as we move further into 2019

- The Personal Consumption Expenditure (PCE) index – which is the Fed’s preferred measure of overall inflation, is hovering stubbornly around 2%, which is generally in line with the Fed’s target

- GDP growth should moderate due to increased borrowing costs and a less accommodative monetary environment, indicative of a late-stage business cycle

- Political uncertainties will likely continue to contribute to volatility as financial markets respond to short-term headline issues; areas of uncertainty include Brexit, turmoil in Venezuela, and continued global trade negotiations

Growth Assets

- Market volatility in 2018 returned to more historical levels as global equity markets corrected from all-time highs; volatility should continue through 2019

- Tax reform and favorable administrative policies should continue to fuel earnings growth in the short term, providing a foundation for tailwinds for equity markets

- Developed and Emerging Markets continue to enjoy economic expansion but have been hampered by protectionist US trade policies and will be affected by the strength of the US Dollar; as market volatility and the strength of the US Dollar return to more normalized levels, a diversified portfolio may play an increasingly important role in supporting returns and risk exposure

Defensive Assets

- Fed rate increases have resulted in a flattened yield curve as long bond rates have been slow to react. Current projections call for no Fed rate hikes in 2019 with a rising likelihood of rate decrease(s)

- Long-term US bond yields will continue to be pressured by high demand from the yield-starved global bond market

- Prudent investors should avoid the temptation to reach for yield by positioning portfolios with shorter maturities and higher quality, emphasizing total return over yield

The INTRUST Market Perspectives are the consensus of the INTRUST Bank, N.A. ("INTRUST") Wealth Investment Strategy team and are based on third party sources believed to be reliable. INTRUST has relied upon and assumed, without independent verification, the accuracy and completeness of this third party information.

INTRUST makes no warranties with regard to the information or results obtained by its use and disclaims any and all liability arising out of the use of, or reliance on the information.

The information presented has been prepared for informational purposes only. It should not be relied upon as a recommendation to buy or sell securities or to participate in any investment strategy. The Forward–Looking Perspectives are not intended to, and should not, form a primary basis for any investment decisions. This information should not be construed as investment, legal, tax or accounting advice. Past performance is no guarantee of future results.

| Not FDIC Insured | No Bank Guarantee | May Lose Value |

Recommended Articles

.png?Status=Temp&sfvrsn=91c53d6b_2)