Personal Banking

Quarterly Perspectives — Q2 2018

In January we published our 2018 Perspectives. Now that we are halfway through the year, we believe an overarching theme of global economic convergence is continuing to fuel global growth. Below are our reviews and reflections on our earlier viewpoints.

Economic Themes

Global Economy

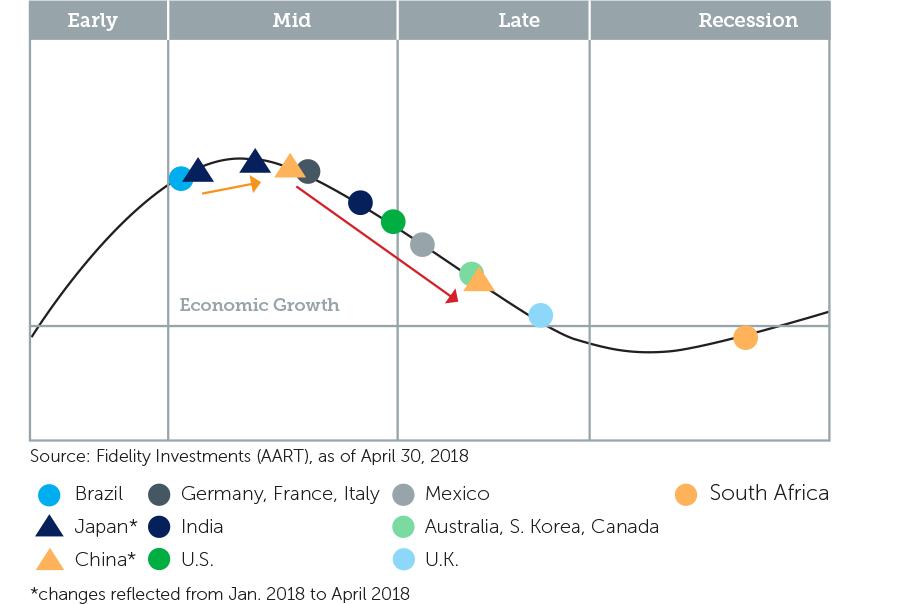

Review: We expect synchronized global expansion to continue into 2018 as most of the world’s major economies will remain in the mid-to-late business cycle.

Reflect: Even though China and Japan have moved further through the expansion stage, most of the major economies remain grouped in the mid-to-late cycle. Higher energy prices will be watched closely as a potential drag on global economic expansion.

Economic Cycle

U.S. Economic Growth

Review: We forecast a continuation of GDP growth as our baseline scenario, fueled by tax reform, deregulation policies, synchronized global growth, and consumer strength.

Reflect: While we maintain our viewpoint we note that factors such as trade tariffs and slowing global economies will affect the rate of US GDP growth.

U.S. Inflation and Fed Policy

Review: We expect more upward pressure on inflation partially driven by growth in consumer wages and spending but the wave of retiring baby boomers and the impact of technology will keep inflation from overheating.

Reflect: Inflation has increased slightly but remains well within the Fed’s target range since we published our January outlook. Fed policy appears to indicate future Fed rate increases and/or balance sheet reductions will be modest and data-dependent.

U.S. Labor Market

Review: We anticipate continued strength in the labor market driven by economic growth as the economy transitions from under-employed to fully-employed.

Reflect: Monthly job creation remains strong and the unemployment rate continues to fall toward historic lows, creating a struggle for many businesses to fill open positions and leading to increases in wage pressure.

Market Implications

Review: Our baseline economic backdrop is more favorable for equities than fixed income, and long-term asset class returns may trend below historical averages.

Reflect: Our viewpoint remains the same.

Equities

Review: Our forecast for ongoing economic expansion – with limited, but increasing recessionary risks – implies US equities may continue to advance. Geo-political uncertainty remains a concern and may impact near-term performance. Volatility in the domestic market was substantially below normal levels in 2017 but market volatility may return to higher levels in 2018.

Reflect: Equity markets experienced a long-overdue market correction in 1Q18, resulting in reduced global valuations. Strong earnings – a result of favorable tax policy changes and strong global economies – may continue to create an attractive environment for equities.

Fixed Income

Review: We believe bonds may face headwinds as the economy continues to reflate, with upward rate pressure from Fed rate increases and a strengthened global economic backdrop. Generally, during the late business cycle phase the yield curve flattens – a trend that unfolded in 2017 and may continue through 2018.

Reflect: The FOMC has moved short-term rates higher and stubbornly low foreign yields have kept long-term rates low, producing a flattened yield curve for bond investors. As the Fed continues to tighten monetary policy through rate increases and balance sheet reductions, we anticipate that bonds will face headwinds and near-term appreciation may be limited.

Treasury Yield Curve

Alternative Investments

Review: We expect alternative assets to play an increasingly important role for investors, as equity volatility may increase and fixed income may continue to experience lower returns. The environment for Real Assets may be favorable as interest rates increase and Absolute Return strategies may benefit from increase market volatility.

Reflect: Our viewpoint remains the same. As inflation increases and market volatility returns to normalized levels, non-correlated assets will play a crucial role in reducing portfolio volatility and stabilizing returns.

Portfolio Implications: Does the probability of increased volatility and lower future returns warrant dramatic investment strategy changes? We do not believe so. Our professional experience and research suggests that long-term investment success is driven mostly by factors that are within the control of investors. This list includes adhering to a disciplined investment process, saving more, working longer and spending less. These controllable factors far outweigh the impact of changing a portfolio’s asset allocation based on anticipated market conditions.

Our focus continues to be on constructing portfolios that are designed to achieve our clients’ desired outcomes as opposed to chasing recent market performance. Given the uncertainty that lies ahead, broad diversification should continue to provide downside protection and help to preserve wealth.

Asset Class Rotation

Integrate Goals-Based Investing and Tax-Smart Strategies: With increased volatility and lower return expectations across many asset classes, managing returns through smart tax management and goals-based investing becomes a crucial part of successful portfolio construction. We believe clients should align their wealth with their goals and work with trusted advisors to construct portfolios built for long-term goal attainment.

Diversification Benefits: After an extended period of outperformance from equities, we believe a consistently rebalanced and diversified portfolio will be rewarded in the long run.

Alternative Strategies: Alternative Investment solutions may help to increase returns and reduce portfolio risk amid increased volatility and lower return expectations for equities and fixed income. Absolute Return investments can help augment fixed income allocations by providing diversification benefits and potentially enhancing returns. Real Return strategies can help protect against potential inflation shocks. For qualified purchasers, Private Equity investments may help enhance a portfolio’s long-term return potential.

Closing Thought

While we continue to monitor economic, monetary, and market conditions, we believe the key to successfully achieving financial goals requires formulating a good plan based on sound investment principles and sticking to it.

The INTRUST Market Perspectives are the consensus of the INTRUST Bank, N.A. ("INTRUST") Wealth Investment Strategy team and are based on third party sources believed to be reliable. INTRUST has relied upon and assumed, without independent verification, the accuracy and completeness of this third party information.

INTRUST makes no warranties with regard to the information or results obtained by its use and disclaims any and all liability arising out of the use of, or reliance on the information.

The information presented has been prepared for informational purposes only. It should not be relied upon as a recommendation to buy or sell securities or to participate in any investment strategy. The Forward–Looking Perspectives are not intended to, and should not, form a primary basis for any investment decisions. This information should not be construed as investment, legal, tax or accounting advice. Past performance is no guarantee of future results.

| Not FDIC Insured | No Bank Guarantee | May Lose Value |

Recommended Articles

.png?Status=Temp&sfvrsn=91c53d6b_2)