Zero Balance Accounts

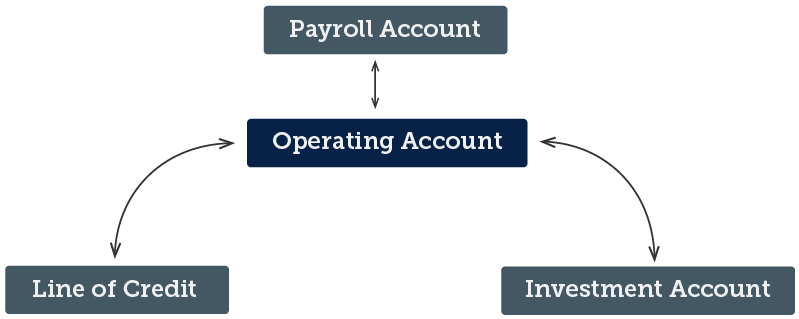

Use several purpose accounts to consolidate your company's cash into one primary account.

An INTRUST Zero Balance Account provides you with the ability to use several purpose accounts – payroll, depository and expenses, for example – to consolidate the company's cash into one primary account. As checks or deposits are presented, funds are automatically transferred to or from the primary account to the purpose accounts. The purpose accounts maintain a zero balance.

- Consolidate cash into one account

- Simplify account reconciliation

- Conduct transfers automatically

- Allow for separation of duties

Sweep + Zero Balance

Maximize Investments

Use a Zero Balance Account in conjunction with a Sweep Account to maximize your invested funds.

ZBA Auto Allocation

INTRUST Bank's innovative ZBA auto allocation product is designed for companies utilizing multiple ZBAs for individual corporate accounts. Funds from the ZBAs are funneled to a master account which sweeps to an overnight repurchase agreement or line of credit. ZBA auto allocation keeps a running “balance” for each account and provides a report at the end of each period with beginning and ending balances for each account.

Balance Allocation

- INTRUST auto allocation begins with a zero balance for each account at start up, unless you specify a starting balance.

- Auto allocation accumulates actual debits and credits (excluding your ZBA transactions) during each period for each account.

- Provides a beginning and ending balance for each account.

- Optional cost of funds feature. A cost of funds rate can be applied to the daily balance in each account, which is then accrued to a monthly Charge or Earnings, which is included on your monthly report.

Get started

Ready to run your business more efficiently? Contact us today to speak with a Treasury Management specialist and learn more about how INTRUST can help your business.

Send us a message

.png?Status=Temp&sfvrsn=91c53d6b_2)